European component growth may slow down

Hermann Reiter concludes, “Although the trend may now be clearly downward, and this has been visible for quite some time and is expected to continue for some time, we must be cautious in our forecasts. ”

On February 5, DMASS Europe eV released data showing that the European component distribution market ended its growth trend in the fourth quarter of last year and fell into a downturn weakness.

Distributors and Manufacturers Report organized by DMASS states that Europe's Q4 2023 consolidated component sales were EUR 4.45 billion, down 17.3% from Q4 2022. Of this, the semiconductor increase was -18.5% to €3.1 billion , and the IP & E (interconnect, passive and electromechanical) segment declined 14.3% to €1.35 billion.

Looking at the full-year 2023 consolidated component sales figures for Europe, they increased slightly by 0.2% to €21.0 billion, slightly above the 2022 record. In terms of full-year growth, semiconductors grew by 4%, while IP & E slipped by 7.7%.

Hermann Reiter, Chairman of DMASS, said: “The expected slowdown was mitigated by the good performance in the first half of 2023, leading to another record year. Admittedly, distribution revenues were driven by orders and sales in 2024, which significantly improved the performance in 2023. The result is that we now face a contraction in the market that will return our business to long-term average growth levels. Our hopes for 2024 rest on the overall market upturn that artificial intelligence will bring. We expect this impact to occur up to the end of 2024 for Europe as a whole, for component distribution and especially for its customers.”

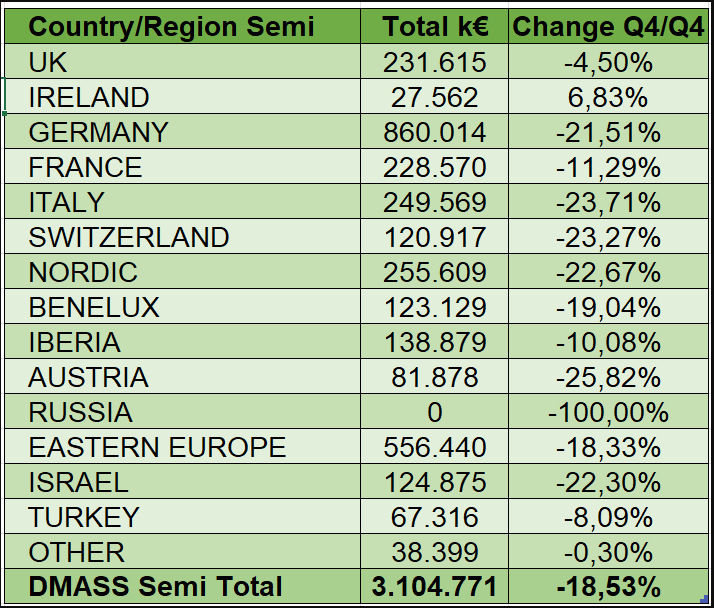

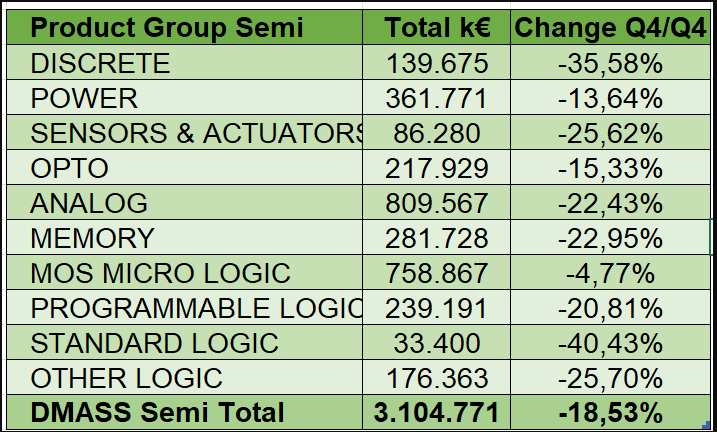

European Semiconductor Distribution Sales Decline 18.5% in Q4 2023

In the fourth quarter of 2023, European semiconductor distribution sales declined 18.5% to €3.1 billion.

Regionally, no country maintained positive growth and there were significant differences between regions.

On a product basis, the only major category with impressive and significant growth was microprocessors, which increased by 17.6%. The rest of the categories saw low single-digit declines, even more than 40%. As usual, the Programmable Logic, MOS Micro and Power categories continue to perform well, although categories such as Small Signal, Sensors, Optoelectronics, Memory, and Standard Logic performed less well.

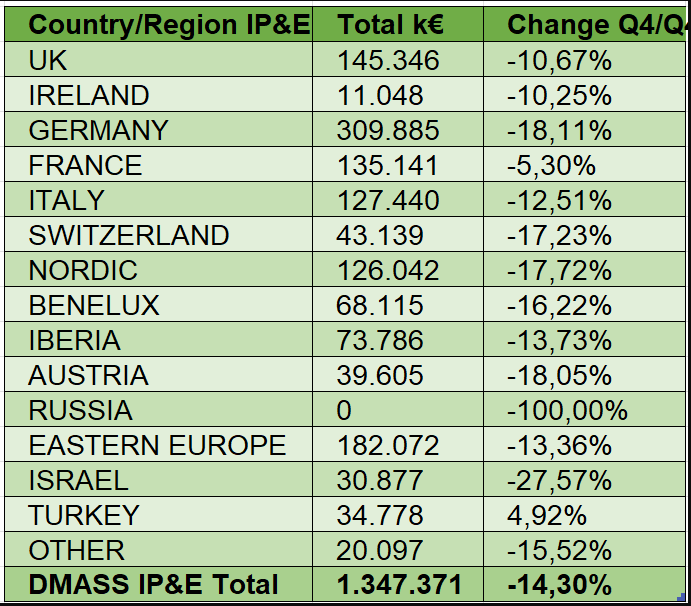

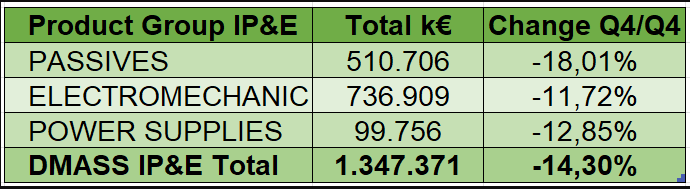

Interconnect, passive and electromechanical component growth continued to slow in Q4

In the fourth quarter of 2023, the European IP&E distribution market declined by 14.3% to €1.35 billion. Declines in the 3 main categories of interconnects, passive and electromechanical components all remained in the low single digits.

In terms of countries and regions, only two countries, Turkey and Romania, remained optimistic in the quarter, while all other countries experienced varying declines of 5% to 25%.

At the product level, passive products faced a bigger drop than the other two categories.

Hermann Reiter concludes, “Although the trend may now be clearly downward, and this has been visible for quite some time and is expected to continue for some time, we must be cautious in our forecasts. This is because it is now influenced by too many uncertain political and technical factors that make market forecasts more elusive.”